In the latest Export Connect online forum series, we collaborated with Food and Fibre Gippsland, Shyan Trading, Global Victoria and AUSVEG to deliver an online forum on the Malaysian export market. In this first instalment of a two-parter blog, we share the key insights gleaned from in-market specialists and buyers about the Malaysian market.

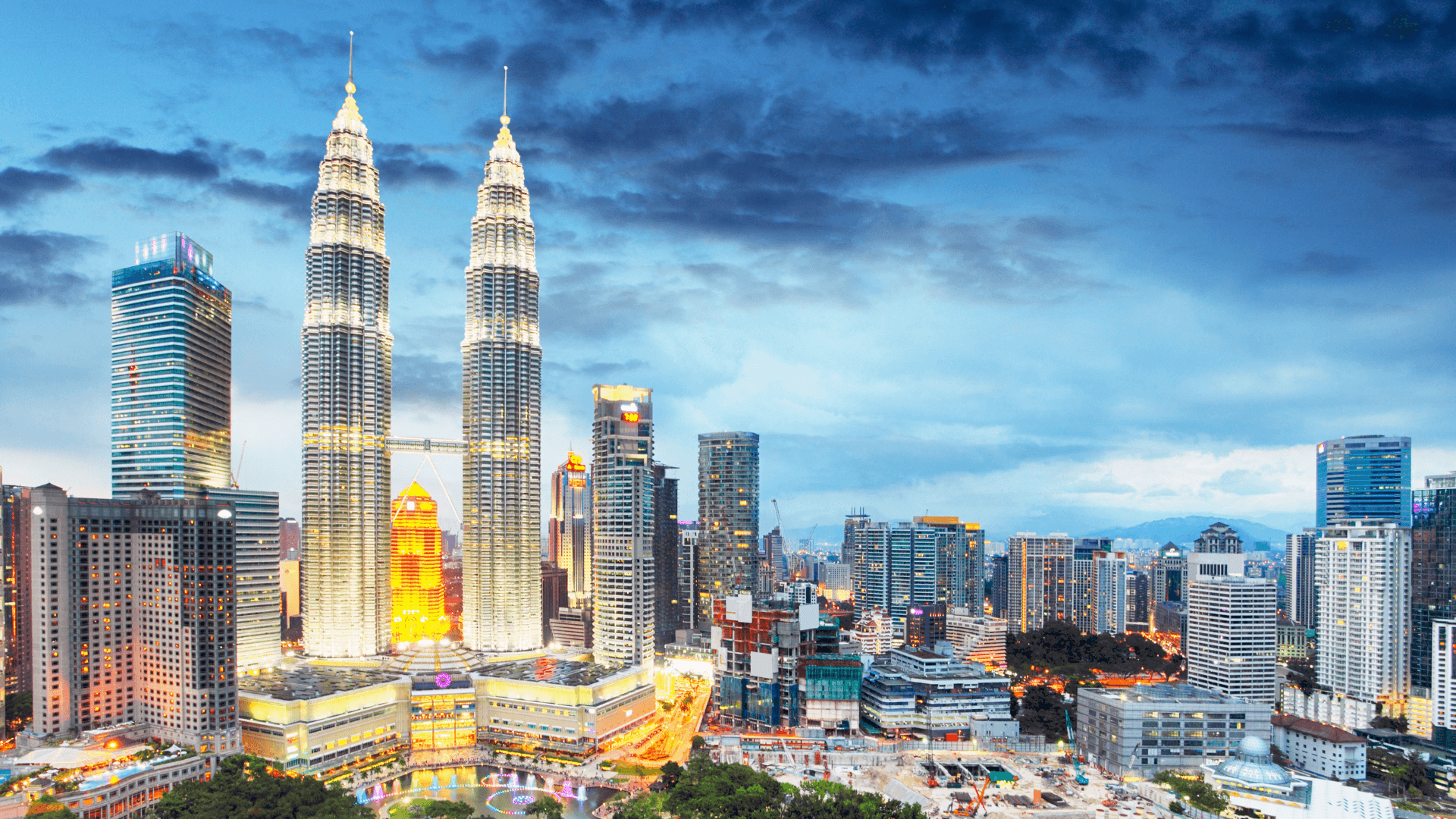

Malaysia may not have been at the top of the pile for many exporters in the past, but with a customer base that is growing and changing, it is one many are starting to think seriously about. Like many Asian countries, the urban population is growing, the middle class is expanding, and expectancy and education is also on the increase. With these changes comes a demand for more international products as well as health and lifestyle based products.

For exporters, there is some excellent news when dealing with Malaysia. The country is an open economy with over 50 bilateral investment treaties and over 20 treaties with investment provisions. For ease of doing business, the nation sits relatively high compared to the world and has trade partners with Australia, New Zealand, Canada, the USA, Japan, Hong Kong, South Korea, India, Chile, Mexico, Vietnam and Indonesia, to name a few.

In the latest Export Connect Webinar series, we collaborated with Food and Fibre Gippsland, Shyan Trading, Global Victoria and AUSVEG to deliver a webinar on the Malaysian export market.

Malaysian Key Demographics

Like many other Asian countries, Malaysia has a rapidly growing population – it is expected to reach 38 million by 2040. It is, however, an aging population with those aged over 65 expected to double in the next 3-4 years. Offsetting this is a falling birth and fertility rate, which is seeing a growth in female employment and literacy rates, which is expected to continue to grow in the next two decades.

Due to an expanding middle class, Malaysia is becoming a more attractive export market for many companies. It is not an overly high-end market, but that may well change with the growing middle class. Migration is high and expected to continue, with foreign citizens living in the country expected to grow by 12% by 2040. This creates more demand for international products.

Health advancements in the country are leading to better living standards and, therefore, a better life expectancy. The Government is encouraging people to exercise and eat better, which is, in turn, creating more demand for fresh, healthy products.

Consumer Trends in a Growing Market

Malaysia is becoming increasingly westernised, with consumers who are brand conscious and price-sensitive, but at the same time becoming more open to trying new foods. Word of mouth and reviews drive the trend of trying new products, and with a large amount of the population on social media, it opens up a good marketing option for international brands.

With a combination of the Government’s push to become more healthy and the COVID pandemic, consumers are looking for high-quality foods with health benefits. The pandemic has seen a reduced rate of brand loyalty as consumers are now shopping at different stores, looking to buy products that are better for them and widely available.

Michael Coote, National Manager for Export Development at AusVeg, notes an overall trend for fresh vegetable exports in Malaysia. Despite the pandemic, Malaysia is the third-largest importer of fresh vegetables from Australia in both value and volume. The most exported products include carrots, potatoes, celery, broccoli and cauliflower with smaller amounts of onions, pumpkin, lettuce, spinach and asparagus.

He notes that freight connectivity has been one of the main issues over the last year, which affects highly perishable products. Freight rates are expected to be slightly higher than pre-COVID in 2021, but Malaysia is quite an accessible market with short sailing times, so a lot of freight can be moved from air to sea transport with little issue.

There is a lot of room for mid-range brands to make in-roads in the Malaysian market, particularly for those with a product that is seen as having health and lifestyle benefits.

Jeremy Ng, Managing Director of Shyan Trading, notes during the webinar that there is certainly growth and trends happening in the Malaysian market, particularly for imported goods. He notes that if the product normally requires a lot of sampling to get consumers to buy, it isn’t growing as well as normal, but variations on already popular products are seeing an increase in growth (snacks, for example).

He notes that the best categories for growth, at least in the short term, look to be health food (plant-based particularly), organic (children and baby food and milk), and baby food and toddler snacks. Mr Ng does make a point that health products like “Free From” aren’t as popular in the Malaysian market.

Benjamin Lim, Trade Director for South-East Asia for Global Victoria, agrees that vegan and vegetarian based products are on the increase; however, they are growing at a much slower rate than in Australia by comparison. Consumers in Malaysia are still turning to traditional alternatives such as vegetables and soy over pseudo-meat products.

This is the end of the first part of a two-parter insights series. We hope you’ve found this overview of our recent online forum on the Malaysia market helpful. As always, if you’ve got any questions or want to discuss export opportunities for your company, feel free to drop us a line at Export Connect – we’d love to hear from you.